Are you feeling financially burdened by your monthly bills? All those expenses can add up, and sometimes it seems impossible to make ends meet. Don’t give up hope yet! This blog post will provide six helpful tips on cutting down your expenses so that more cash is in your pocket for yourself or other financial goals. Keep reading to learn more about reducing what comes out of your bank account each month.

- Take advantage of discounts from your utility companies.

Utility bills can often eat up a significant chunk of your monthly budget. But did you know that utility companies offer various discounts and incentives for their customers? Many companies offer discounts for seniors, veterans, and low-income households.

Some also have programs that reward customers for conserving energy, such as using energy-efficient appliances or installing intelligent thermostats. Regarding your electricity and gas connection, you can also save money by signing up for a fixed-rate plan, which locks in prices and eliminates the risk of unexpected price hikes. So, reach out to your utility company and see the discounts you are eligible for.

- Cancel any subscriptions you’re not using.

Saving money is easier said than done, especially regarding monthly bills. However, you can cut back on expenses in several ways without sacrificing your quality of life. One effective method is to take a closer look at your subscriptions. Are you using all of them regularly? If not, it’s time to cancel unnecessary subscriptions and put that money towards something that truly matters. By doing so, you’ll save money, declutter your life, and focus on what’s truly important.

- Shop for the best deals on the Internet, phone, and other services.

In today’s financially challenging times, saving money has become a top priority for many. An effective method to cut costs is to search for the best deals on essential services such as Internet and phone bills. This strategy can save you significant money over time, especially if you do it regularly. By being aware of your options, you can find the best packages that match your needs and budget.

Many companies offer introductory deals for new customers, so shopping around and seeing what you can find is worthwhile. With the wealth of online information, it’s easier than ever to discover the deals that suit your requirements. By taking the time to research, you can reduce your monthly expenses and enjoy the benefits of a little extra cash in your pockets.

- Use energy-saving light bulbs.

When saving money on your monthly bills, many options exist. Switching to energy-saving light bulbs is a straightforward way to reduce your expenses. Not only do they use less electricity than traditional bulbs, but they also last longer, which means less money spent on replacements.

Plus, many energy-saving bulbs now come in various sizes and styles, so you don’t have to sacrifice design for functionality. Making the switch to energy-saving bulbs may seem like a small step, but it can significantly impact your wallet in the long run. So go ahead and make the switch. Your bank account will thank you.

Also Read: Revamp Your Home with These 6 Energy-Efficient Home Improvement Ideas

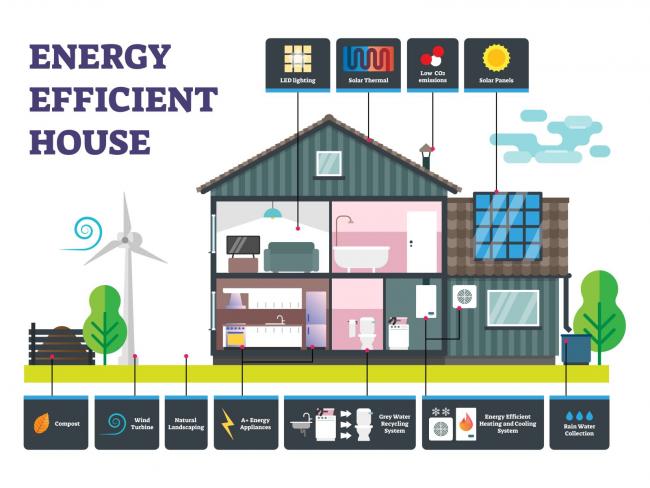

- Utilize renewable energy sources when you can

Did you know that going green can also help you save money? By utilizing renewable energy sources, such as solar power or wind turbines, for your home’s energy needs, you can significantly reduce your monthly bills. Although the initial installation costs of such systems may be high, the long-term benefits outweigh the expense. Not only will you see a decrease in your bills each month, but you will also be doing your part to preserve our planet for future generations.

- Ensure all appliances are running efficiently.

Ensuring that all your appliances are running efficiently means regularly checking on your refrigerator, washing machine, dryer, stove, and any other significant appliances to ensure they’re not using more energy than necessary. Inspect the seals on your fridge and freezer doors, clean the lint traps on your dryer, and ensure your stove burners are clear and clean. Keeping everything in good working order can reduce your energy usage and save money on your monthly bills. Plus, you’ll do your part to help the environment by reducing your carbon footprint.

Final Words

The path to a healthier wallet requires dedication and hard work, but it doesn’t have to be overwhelming. Many simple yet effective ways to save money on your monthly bills exist.

Whether canceling unused subscriptions, utilizing energy-saving light bulbs, taking advantage of discounts from utility companies, comparing deals for Internet and phone services, ensuring all appliances run efficiently, or using renewable energy sources – every penny saved will add significantly over time. Small financial decisions may not seem like much, but they will eventually improve your future. Start saving today and watch your wealth grow.